[ASEAN]Southeast Asia becomes a strategic location for chip giants to lay out?

Translated from https://mp.weixin.qq.com/s/iZwmPWjqYCQ_DPUCe4iU_g

Black swan events such as epidemics and natural disasters are constraining the release of supply-side capacity, global chip shortages are disrupting the industry's supply chain, and trade sanctions are intensifying the industry's move from division of labour and cooperation to ownership. China, the US, Japan and South Korea are at the centre of the conversation and are in a new race to further strengthen or consolidate their industrial advantages.

However, beyond the limelight, many other countries are stepping up their efforts to catch up in the semiconductor industry, which is directly related to national and regional competitiveness, in an attempt to strengthen their semiconductor technology and strength. It is easy to see from the plans and strategies of Southeast Asian countries that they all want to develop their own semiconductor ecology and move closer to higher value-added segments of the industry chain. On a global scale, Southeast Asia is attractive for a new round of large-scale manufacturing industry chain shifts. The Southeast Asian Scholar has compiled this article for readers' consideration.

01 Southeast Asia benefits from US-China competition

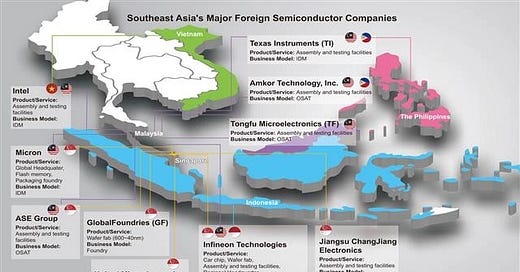

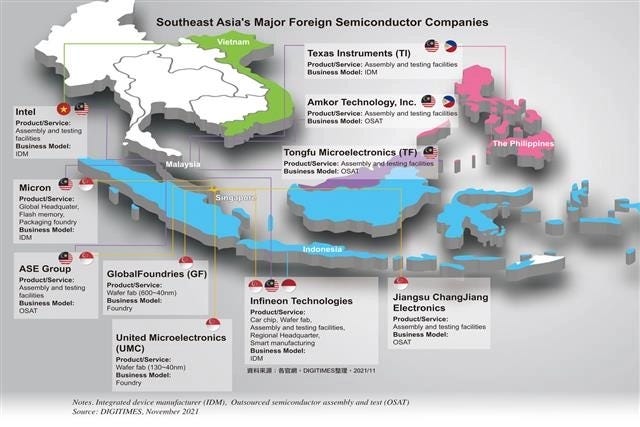

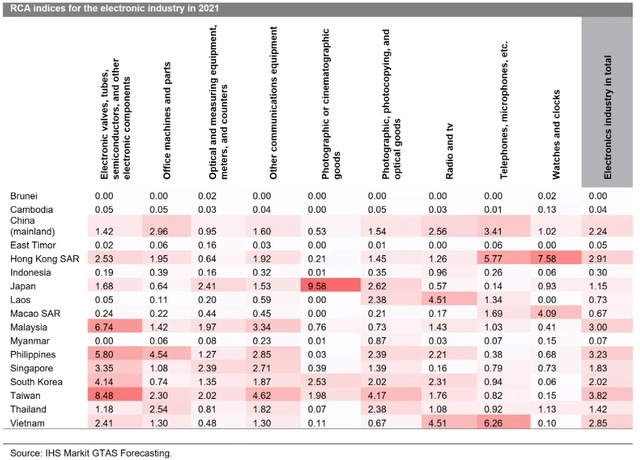

Southeast Asian countries also occupy a prominent position in the global chip industry chain, with a 27% share of the global chip testing and packaging market. It is estimated that the chip market size of Southeast Asian countries will be about US$27 billion in 2020 and will reach about US$41.1 billion in 2028.

Also stacked with factors such as the COVID19 outbreak and the Russia-Ukraine conflict, Southeast Asian countries are playing a bigger role in the global semiconductor production line and supply chain.

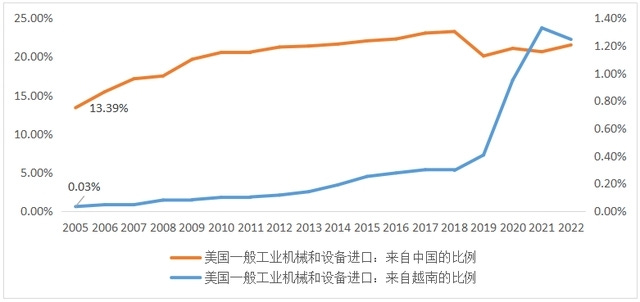

Semiconductor companies are shifting their manufacturing bases from mainland China to Southeast Asia, mainly to avoid risks on the manufacturing side, in addition to political considerations.

Southeast Asia may benefit from the demand for a diversified and more resilient supply chain as a result of trade friction between the US and China.

The US "Chip Act" has set off a wave of competition for the development of the global chip industry. After all, for many non-US companies, the cost of building factories in the US is huge, and semiconductor factories can only accelerate their search for mainland China alternatives in Southeast Asia.

This volatility provides an important opportunity for established and emerging players in Southeast Asia to fill the supply gap created by the US' attempts to isolate mainland China from the chip market.

Southeast Asia, is becoming a treasure trove for chip giants to bet on.

02 Singapore: Manufacturing base with a mature industry chain

Singapore is a manufacturing hub with a mature semiconductor industry chain from IC design, manufacturing to packaging and testing.

Global semiconductor majors have chosen to set up factories in Singapore, such as ST, Infineon, MediaTek, Micron, and large OSAT companies including Sun & Moon and Changdian Technology, which also have assembly and testing facilities in Singapore.

It is home to Micron's global operations headquarters, three memory wafer fabs and an assembly and test facility. It is also home to Infineon's Asia Pacific headquarters, where it manages key functions including R&D, supply chain, sales and marketing.

Meanwhile, GlobalFoundries and UMC both have fabs in Singapore that produce chips up to 40nm process.

Large OSAT companies, including Sun & Moon and Changdian Technology, also have assembly and test facilities in Singapore.

Global chipmakers have invested close to US$200 billion in Singapore to reduce risk and improve supply chain resilience.

Ge-chip announced a US$4 billion investment to expand its manufacturing capacity, which is expected to increase its capacity in Singapore to 1.5 million 300mm wafers per year.

UMC will invest US$5 billion in a new fab in Singapore to produce 22 and 28nm chips to capitalise on demand for 5G and automotive electronics.

03 Malaysia: an important location for packaging and testing, with new investments from leading companies

Due to its important position in packaging and passive components, Malaysia has quietly played an important role in this global chip wrestling war.

According to Statista data, Southeast Asia holds 27% of the global semiconductor packaging market share, and Malaysia alone accounts for about half of it. There are more than 50 semiconductor companies in Malaysia today, most of which are multinational companies such as AMD, Infineon, STMicroelectronics, Intel, Renesas, Texas Instruments, etc.

According to SEMI data: Penang, Malaysia accounts for approximately 8% of the global semiconductor industry's back-end production, making it the world's leading microelectronics assembly, packaging and testing region. On September 21, 2022, TAIYO announced that it will invest approximately 18 billion yen in a new MLCC plant at its subsidiary in Sarawak, Malaysia, as it expects demand for MLCCs to continue to expand in the future.

Bosch is currently building a new semiconductor test centre in Penang, Malaysia, which will be used to test finished semiconductor chips and sensors by 2023. 2022 saw the groundbreaking of Infineon Technologies' new state-of-the-art wafer fab in Guling, Malaysia, which is expected to be completed in the third quarter of 2024.

In recent times, news of flooding and city closures in Malaysia has touched a nerve in the semiconductor industry, affecting the production of many overseas technology companies' factories there, and the potential impact on the supply chain. Intel is accelerating its expansion with plans to invest 30 billion ringgit (US$7.1 billion) in Malaysia, with the intention of building packaging and testing lines in the country over the next 10 years. in December, Ensyn Semiconductor held a groundbreaking ceremony for the expansion of its Hibiscus Malaysia back-end plant, which will add 25 billion units of capacity, an 85% increase in capacity. Rohm decided to invest in a new facility at its Malaysian subsidiary RWEM to enhance production capacity for analogue LSIs and transistors for which there is a growing market demand. Bosch plans to invest more than 400 million euros in Malaysia and expects to start operations at its new test centre in Penang in 2023.

04 Thailand: Parts manufacturing, a place for Japanese companies

Thailand is the 13th largest electronics and components manufacturing base in the world and a hub for long-term investment by Japanese companies, with Sony, Rohm, Samsung, Murata, Toshiba and Kyocera all having established Fabs in Thailand.

The Sony Group will invest approximately US$70.7 million to establish a semiconductor plant at its production site in central Thailand, which will commence operations in the financial year ending March 2025, primarily for the manufacture of image sensors.

Murata has begun construction of a plant to manufacture capacitors in Thailand, the first time Murata has produced MLCC products in the country, and the new plant, which will cost 12 billion yen, will be operational by October 2023.

Kyocera plans to build a new plant for semiconductor packaging in Vietnam, with the size of the investment estimated at around 10 billion yen.

Samsung has a total of six factories in Thailand and earlier this year injected US$920 million into its electronic components plant in Thai Nguyen.

05 Vietnam: Local value for money, corporate foundry investment takes its place

Vietnam also has one of the most open economies in the world, with 15 free trade agreements.

Under the VKFTA, Vietnam abolished 31 tariff lines imposed on Korean electronics and components, which prompted Korean semiconductor giant Samsung to build a factory in Vietnam.

Although Vietnam's semiconductor industry chain is currently weak, the country has the convenient geographical advantage of bordering China.

As well as the industrial chain already formed by Japanese and Korean automotive majors with factories in the region, it attracts investment from major electronics manufacturers towards a capital-intensive, technology-oriented electronic technology industry cluster.

Local enterprises in Vietnam are also becoming more active in the IC industry, including capacity expansion and mergers and acquisitions, and may become an important part of the semiconductor market in the future.

In 2022 Samsung intends to invest a further US$3.3 billion in Vietnam to continue to expand its operations in the country, while testing and producing FC-BGA high-performance semiconductor packaging substrates in Taiyuan Province, located in northern Vietnam, with plans to officially start mass production in July 2023.

Intel invested US$1 billion in a chip assembly and testing plant in Vietnam many years ago, which has remained an important production site for the Intel Group until now.

In November 2021, Anchor Technology, again announced that it will build a new intelligent chip packaging and testing plant in Vietnam's Bac Ninh province.

This year, in order to solve the capacity problem as soon as possible, Intel has increased its investment in Vietnam by US$475 million. After this investment, Intel's total investment in Vietnam has reached US$1.5 billion since 2006.

Kyocera, a major Japanese electronics parts manufacturer, announced in October that it plans to build a brand new plant for semiconductor packaging in Vietnam, with an estimated investment size of about 10 billion yen.

Whether it is the previous site selection of Samsung, Intel, etc. in Vietnam, or the recent expansion and new construction plans of many companies in Vietnam, Vietnam is considered to have many of the world's leading semiconductor companies foundry.

06 The future of the chip industry in Southeast Asia

Historically, it appears that downstream to upstream and bias to all have been the general pattern of development of the semiconductor industry shift.

For the historical development of the global semiconductor industry, the semiconductor market has been constantly shifting, with the industry shifting from Europe and the US to Japan and Korea and then to China in that order.

However, in the new development of the global semiconductor industry, it is bound to take a long time for some South East Asian countries to transform from [foundry countries] to [technology R&D centres] as there are still many constraints.

In general, the semiconductor ecosystem in Southeast Asia has a high potential for growth with the rapid development of the economy and foreign trade. This stems from the endogenous growth force of semiconductors in Southeast Asia on the one hand, and the technology industry dividend generated by the US-China game on the other.

But in any case, each country or region has its own most appropriate niche in the global semiconductor chain, a situation that has been shaped by years of gamesmanship.

For countries in Southeast Asia that want to play a more important role, there are still many challenges ahead.